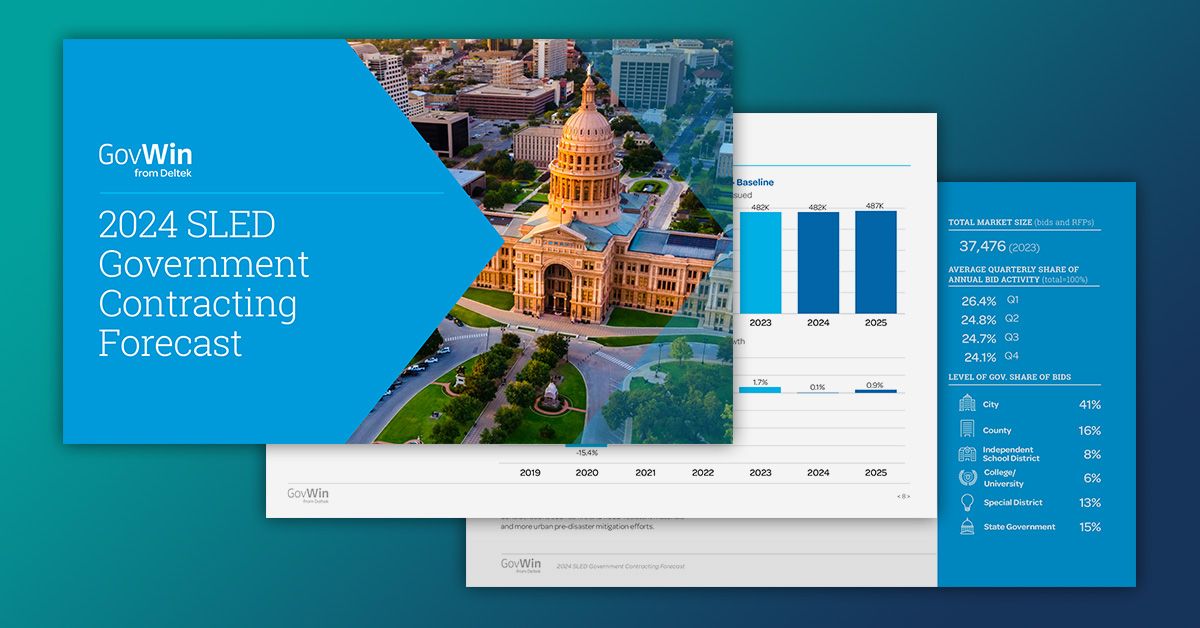

2024 SLED Government Contracting Forecast

Published: December 20, 2023

FeaturedSLED Market AnalysisArchitecture, Engineering, and Construction (AEC)Business DevelopmentCommunity DevelopmentContracting TrendsCoronavirus (COVID-19) PandemicEconomic Development/RegulationEducationEducation (Higher)Education (Primary/Secondary)Forecasts and SpendingGeneral Government ServicesHealth CareHealth CareInformation TechnologyJustice and Public SafetyJustice/Public Safety & Homeland SecurityJustice/Public Safety & Homeland SecurityNatural Resources/EnvironmentOperations and Maintenance (O&M)Professional ServicesPublic FinancePublic UtilitiesSocial ServicesTelecommunicationsTransportationTransportation

Given the ongoing economic uncertainty, it’s crucial to chart your business development strategy with a comprehensive understanding of the state, local, and education (SLED) market’s performance and trajectory. Now in its eighth annual edition, GovWin’s exclusive ‘2024 SLED Government Contracting Forecast’ sheds light on the future of the market in the context of the current economic climate, along with industry-specific outlooks for each of our 12 primary industries.

Given the ongoing economic uncertainty, it’s crucial to chart your business development strategy with a comprehensive understanding of the state, local, and education (SLED) market’s performance and trajectory. Now in its eighth annual edition, GovWin’s exclusive ‘2024 SLED Government Contracting Forecast’ sheds light on the future of the market in the context of the current economic climate, along with industry-specific outlooks for each of our 12 primary industries.

What's Inside:

Produced by GovWin’s team of veteran market analysts, this free report provides a two-year annual forecast for 2024-25 of new bids and RFPs issued for the overall SLED market and each of our 12 primary industries. It also includes historical data, reviews of recent trends, insights on key drivers moving each industry forward, and profiles of demand by level of government.

“When BD staff and expertise is limited, the importance of good data to understand the customer environment and pain points is critical. That is the value of what Deltek provides.”

Tammy Rimes, Executive Director, National Cooperative Procurement Partners

From the Deltek Clarity GovCon Industry Study

Sample Key 2024 SLED Government Contracting Forecast Findings:

Possible Economic Contraction

The economy avoided a slump, maintained a slow GDP in 2023, and economists foresee another year of minimal growth with possible slowdown or contraction.

Return To Historical Growth Rates

After two years of significant growth and 2023 marking a return to normal bid levels, 2024-25 will look to return to the long-term average annual trend of around 1% growth in bids per year.

101% of Pre-Pandemic

By 2025, the volume of SLED bids in the baseline forecast should reach 100.6% of pre-pandemic volume.

487K GovWin's 2024 SLED Government Contracting Forecast predicts 482,000 bids & RFPs to be issued in 2024 and 487,000 bids & RFPs to be published in 2025, just enough growth to surpass 2019 for the first time since the onset of the 2020 pandemic.

Get the SLED Market Insights You Need to Stay Ahead of the Competition! Download Report >>

- 03 Executive Summary

- 04 Introduction

- 05 Overall SLED Forecast

- 06 The Economic Outlook

- 08 The Outlook for Competitive Bids

- 09 The Outlook for Cooperative Purchasing

- 10 Individual Industry Forecasts

- 11 Architecture & Engineering

- 13 Construction

- 15 Educational Products & Services

- 17 Environmental Services

- 19 Financial Services & Insurance

- 21 Healthcare

- 23 Operations & Maintenance

- 25 Professional Business Services

- 27 Public Safety

- 29 Technology & Telecom

- 31 Transportation

- 33 Water & Energy

- 35 Summary of the 12 Industries

- 36 Appendix - Methods & Alternate Industry Forecasts